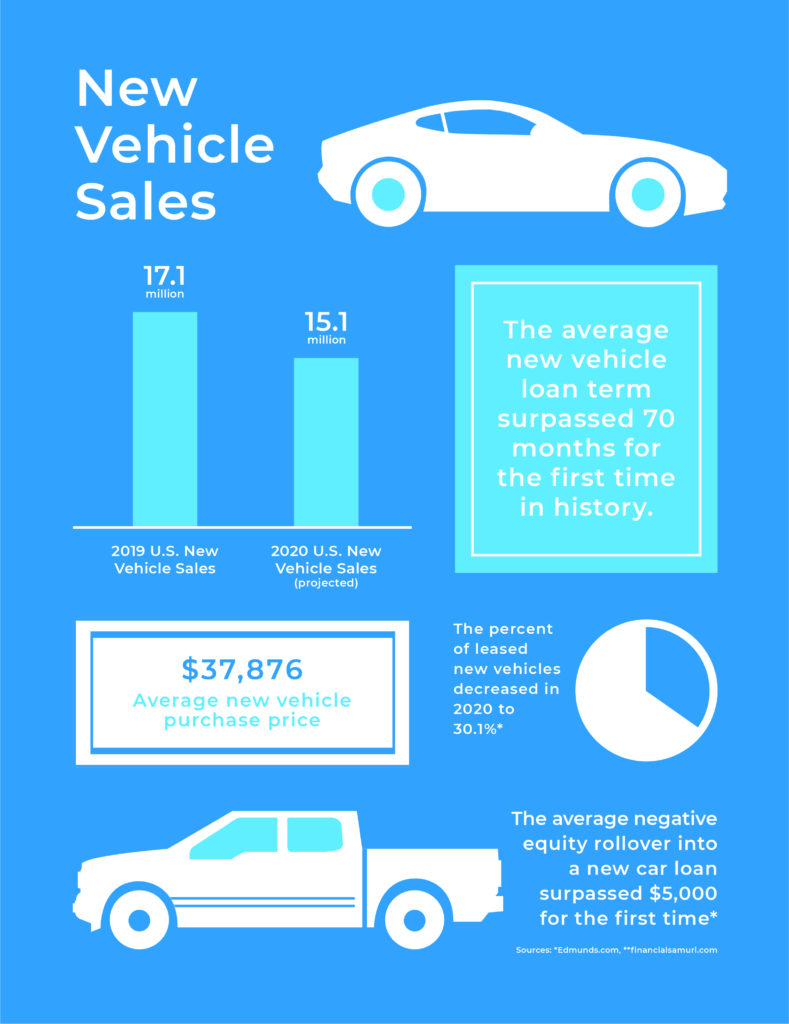

New vehicle sales have seen a healthy rebound since the mid-March shutdown of dealerships. Early estimates of new vehicle sales for 2020 were reduced to 12.3 million, but have been since revised upwards at least three times to the current estimate of 15.1 million. In a healthy economy, US consumers purchase 16.5-17 million new vehicles a year. This is a large decrease, but still not as bad as the 2009 sales slump when (even with the Cash for Clunkers program) US consumers purchased just over 10 million new vehicles.

As we enter the last quarter of 2020, it is time to look at the longer term impacts the COVID pandemic has had on the automobile industry through new vehicle sales. Additionally, what trends will in turn affect the auto insurance industry.

You may wonder—what has caused such a quick recovery? Dealers adapted quickly to ‘touch free’ and online sales processes that just may be here to stay. Additionally, interest rates plummeted, with the average 2020 vehicle finance rate being a mere 4.5% compared to last year’s 7.1%. Carmakers also pulled out the stops on loan lengths as well; as many domestic car companies have advertised zero percent for 84 months.

On the cautionary side, the amount of negative equity being rolled into car loans as well as average new vehicle sales prices both hit all-time highs. $5,000 of negative equity is rolled into the average new car loan and the average sale price of a new vehicle is now $37,876.

Lower purchase interest rates had the effect of lowering leasing as an option, as just over 30% of new vehicles are leased (down from 33% in previous years). Unfortunately, many of these leases do not have gap insurance, and in the event of a total loss, many lessees will be underwater.

Greg Horn

Greg Horn is PartsTrader’s

Chief Innovation Officer.